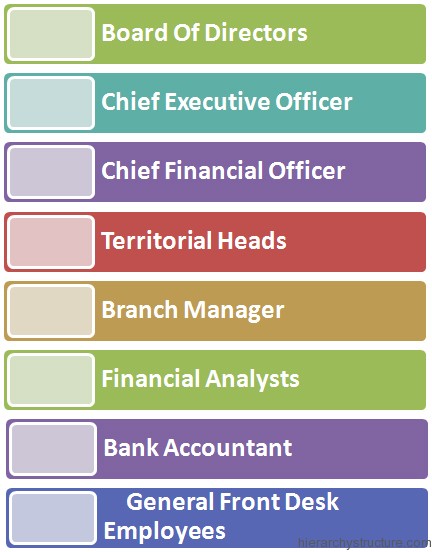

A bank is a public institution which is entrusted with huge responsibility of safeguarding the public money. To successfully such operation with proper responsibility and accountability requires a definite control structure to be in place. The major designations that exist at the levels of corporate banking hierarchy are as follows:

- Board of Directors

- Chief executive Officer

- Chief Financial Officer

- Territorial Heads

- Branch Manager

- Financial Analysts / Financial Consultants

- Bank Accountant

- General front desk employees

A corporate banking hierarchy can be viewed as a pyramid with Chief executive Officer at the top of pyramid. A banking organization has to deal with a number of agencies and functions in their daily operating cycle and to control these operations along with safeguarding the investor interest a well-defined structure is put in place which works like a gear mechanism of a machinery. The overall functioning of the bank is controlled by a board of nominated officials and directors. These nominated officials are representative of investors, government and regulatory authorities. The board is responsible for all policy level decisions in the bank. For day to day functioning and implementing the strategic decisions the bank appoints a Chief executive officer (CEO).

Further there are strategic positions in top management of the bank such as Chief Financial officer, Chief Operating officer, Chief People’s officer and various functional heads such as Business heads or vertical heads for niche verticals such as wealth management, treasury, retail banking, corporate banking, investment banking. It all depends on the areas and verticals the bank operates in. Generally to maintain the span of control and render excellent services to the customer, the area of operation is divided into various geographical regions and these geographical divisions or regions are headed by location heads who are responsible for the business in their territory.

These location heads look after banking operations and service delivery in their area normally through designated branches. The branches are staffed with officers and managers to manage various functions. The branches are headed by Branch managers.

Apart from the staff in business line of the bank there are various other personals employed to support the staffing and regulatory functions of a bank. Bank requires maintaining and confirming up to certain regulatory levels and these employees are responsible for these statutory requirements. Apart from this a ban would also contain official dealing with investments of customers and for this task they are required to employ certified and qualified staff with certifications such as certified financial Analyst, Certified Financial consultants, Certified Public Accountant etc. All in all the hierarchy of a bank is designed in such a way that every action is accounted for and there is complete control and discipline on functioning of the bank. All the officials in a bank are trained to serve the public with due respect, diligence and honesty and since the dealings involve a lot of money, so to exercise caution against misinformation, misrepresentations and frauds.

Know more about Investment Banking Job Hierarchy Click Here